e-TA 5: Delta Method and Bootstrap Techniques

Welcome to e-Tutorial, your on-line help to Econ508. This issue provides an introduction on how to do the piratical works about the Delta-method and bootstrap in R. Hope this will be helpful for your further understanding of Prof. Koenker’s Lecture 5.1

Data Set

The data set used in this tutorial was borrowed from Johnston and DiNardo’s Econometric Methods (1997, 4th ed), but slightly adjusted for your needs. It is called AUTO2. You can download the data by visiting the Econ 508 web site (Data). As you will see, this adapted data set contains five series.

use AUTO2, clear

describe obs: 128 AUTO2 adapted from Johnston and DiNard

vars: 5 11 Sep 2002 12:22

size: 2,560

------------------------------------------------------------------------------------

storage display value

variable name type format label variable label

------------------------------------------------------------------------------------

quarter float %9.0g Quarter of the observation

gas float %9.0g Log of per capita real expenditure on

price float %9.0g Log of the real price of gasoline and

income float %9.0g Log of per capita real disposable inco

miles float %9.0g Log of miles per gallon

------------------------------------------------------------------------------------

Sorted by:

As we did before we need to transform the data in “time series” first:

gen t = _n

label variable t "Integer time period"

tsset t time variable: t, 1 to 128

delta: 1 unit

Running a Dynamic Model with Quadratic and Multiplicative Terms

In the problem set 2, question 4, you are asked to run a linear regression model with non-linear transformation of variables. Suppose for a moment that you have in your hands a data set like the one used here (auto2.dta), and would like to estimate an equation similar to the problem set:

\[gas_{t} = b_{0} + b_{1} income_{t} + b_{2} price_{t} + b_{3} price_{t} ^2 + b_{4} (price_{t}*income_{t}) + u_{t}\]

first you need first to generate the quadratic and other terms as follows:

gen price2= price^2

gen priceinc= price*incomethen regress:

regress gas income price price2 priceinc Source | SS df MS Number of obs = 128

-------------+------------------------------ F( 4, 123) = 117.59

Model | 1.45421455 4 .363553638 Prob > F = 0.0000

Residual | .38027632 123 .003091677 R-squared = 0.7927

-------------+------------------------------ Adj R-squared = 0.7860

Total | 1.83449087 127 .01444481 Root MSE = .0556

------------------------------------------------------------------------------

gas | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

income | -6.109449 2.750048 -2.22 0.028 -11.553 -.6658978

price | 3.090076 2.894747 1.07 0.288 -2.639898 8.82005

price2 | .2839261 .1693137 1.68 0.096 -.05122 .6190723

priceinc | 1.454257 .5879186 2.47 0.015 .290508 2.618006

_cons | -25.52231 11.8968 -2.15 0.034 -49.0713 -1.973312

------------------------------------------------------------------------------

Now, suppose you are asked to calculate the price elasticity of demand at different points of the sample. To do that you will need to:

- Obtain the coefficients of regression:

matrix B=get(_b)

matrix list BB[1,5]

income price price2 priceinc _cons

y1 -6.1094494 3.0900762 .28392614 1.4542568 -25.522308 - Extract the coefficients to scalars:

Or another way to do it: scalar b1=B[1,1] or scalar b1=_b[income]scalar b1=_coef[income]

scalarb2=_coef[price]

scalarb3=_coef[price2]

scalarb4=_coef[priceinc]

scalarb0=_coef[_cons]

scalarlist b1 b2 b3 b4 b0

iii. Calculate the elasticity at different:

gen elastpt=b2+2*b3*price+b4*income

summarize elastpt, detail elastpt

-------------------------------------------------------------

Percentiles Smallest

1% -.7897052 -.8065645

5% -.7665387 -.7897052

10% -.7234885 -.7795596 Obs 128

25% -.4959842 -.7698234 Sum of Wgt. 128

50% -.2754352 Mean -.3273864

Largest Std. Dev. .2598182

75% -.0774807 .0347935

90% -.0073602 .0391868 Variance .0675055

95% .0219321 .0460309 Skewness -.2600589

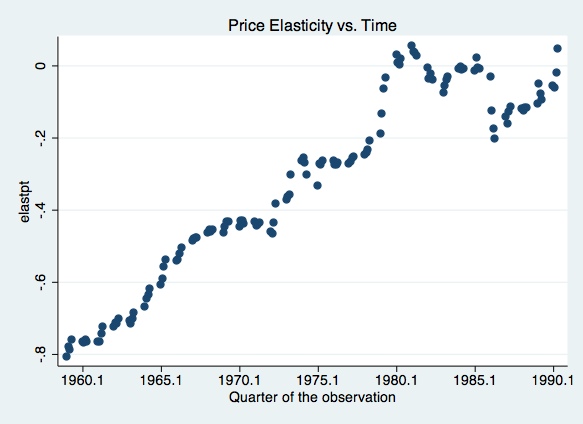

99% .0460309 .0555678 Kurtosis 1.835793 scatter elastpt quarter, xlabel(1960.1 (5) 1990.1) t1title(Price Elasticity vs. Time)

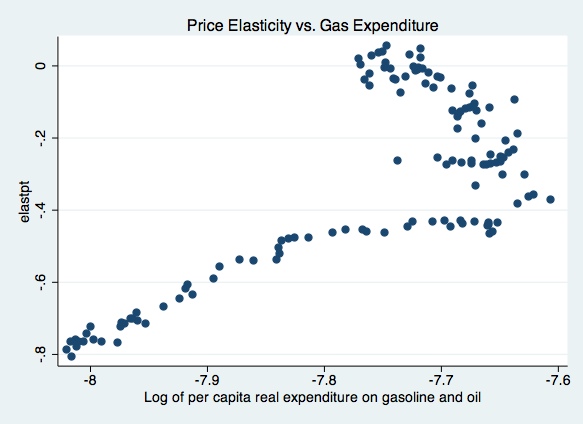

scatter elastpt gas, t1title(Price Elasticity vs. Gas Expenditure)

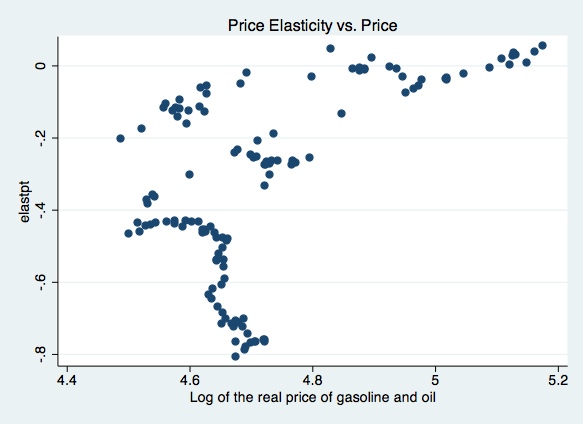

scatter elastpt price, t1title(Price Elasticity vs. Price)

Tip for problem set 2, question 5.

For this question you should:

Interpret the implications of the model.

Calculate the price such that \([b_{2}+2*b_{3}*price+b_{4}*income] = -1 \) Given the formula of elasticity, and assuming \(income=x_{0}\), just find the optimal price. Call it \(p^{*}\).

Examine the partial residual plots

Finally, in the last part of the question 5 you are asked to estimate model 2 and to compute the revenue maximizing price level assuming \(income=\$30.000\) per year. This is a straightforward computation. The interesting part come with the application of the delta method and the bootstrap to achieve reasonable confidence intervals for the optimal price.

Delta-method and Bootstrap

Note that we obtained point estimates. To compute confidence intervals, you will need the Delta-method and/or Bootstrap. In the problem set you are asked to assume that \(income=\$30.000\) per year. For this e-ta, we will assume \(income=log(15)=2.708050\) approximately

Delta-method

For the problem set you are expected to sketch the Delta-method and calculate the derivatives by hand along with the computational routine below.

- Start running the full model again:

regress gas income price price2 priceinc

Source | SS df MS Number of obs = 128

-------------+------------------------------ F( 4, 123) = 117.59

Model | 1.45421455 4 .363553638 Prob > F = 0.0000

Residual | .38027632 123 .003091677 R-squared = 0.7927

-------------+------------------------------ Adj R-squared = 0.7860

Total | 1.83449087 127 .01444481 Root MSE = .0556

------------------------------------------------------------------------------

gas | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

income | -6.109449 2.750048 -2.22 0.028 -11.553 -.6658978

price | 3.090076 2.894747 1.07 0.288 -2.639898 8.82005

price2 | .2839261 .1693137 1.68 0.096 -.05122 .6190723

priceinc | 1.454257 .5879186 2.47 0.015 .290508 2.618006

_cons | -25.52231 11.8968 -2.15 0.034 -49.0713 -1.973312

------------------------------------------------------------------------------

- Recall that you have stored those coefficients under the names b0, b1, b2 , b3, b4. Now you need to get the covariance matrix V of them:

matrix V=get(VCE)

matrix list V symmetric V[5,5]

income price price2 priceinc _cons

income 7.5627648

price -6.5629988 8.3795596

price2 -.00833388 -.27004512 .02866714

priceinc -1.6166822 1.405926 .00149168 .34564825

_cons 30.88608 -33.229023 .62976256 -6.6089597 141.53396

- Next you need to input pstar:

scalar pstar = -(1+b2+b4*ln(15))/(2*b3)

scalar list pstar pstar = -14.137967- And then you need to obtain the gradient vector with the partial derivatives of pstar (optimal price) with respect to each regressor, obeying the order of the covariance matrix:

\[G'= (\frac{\partial{p^{*}}}{\partial{cons}}, \frac{\partial{p^{*}}}{\partial{income}}, \frac{\partial{p^{*}}}{\partial{price}}, \frac{\partial{p^{*}}}{\partial{price2}}, \frac{\partial{p^{*}}}{\partial{price\_income}}) \]

In Stata the vector will be as follows (note that the backslashes separate each row of the vector):

matrix G=( 0 \ -1/(2*b3) \ (1+b2+b4*ln(15))/(2*b3*b3) \ -ln(15)/(2*b3) \ 0)

matrix list G G[5,1]

c1

r1 0

r2 -1.7610213

r3 49.794522

r4 -4.7689342

r5 0 - The next step is to obtain the estimated variance of the optimal price, \(G'VG\):

matrix GVG=G'*V*G

matrix listsymmetric GVG[1,1]

c1

c1 175.19377- Then you can obtain the standard error by taking the square root of this scalar value:

scalar sepstar=sqrt(el(GVG,1,1))

scalar list sepstar sepstar = 13.236079

That’s it. The variable sepstar is the standard error of pstar.

- The last step is to construct your confidence interval, and put the variables in levels, as follows:

scalar CIupper=pstar + 1.96*sepstar

scalar CIlower=pstar - 1.96*sepstar

scalar list CIlower pstar CIupper CIlower = -40.08068

pstar = -14.137967

CIupper = 11.804747

This will give you the confidence interval of the optimal price level. Observe that the results you obtained are for prices in logs. You can try to get the respective results in levels as well, but it is worth to think about whether you can do that directly or you need some additional step because of the non-linearity of the point estimate.

Bootstrap

You are expected to explain the various Bootstrap techniques in words (as if you are explaining for a non-econometrician), along with the complete understanding of the results provided by STATA.

In STATA, you can calculate parametric (Normal), percentiled, and bias corrected bootstrapped confidence intervals for the optimal price as follows:

bs pr=(-1*(1+_b[price]+_b[priceinc]*ln(15))/(2*_b[price2])), reps(1000):

reg gas income price price2 priceincBootstrap replications (1000)

----+--- 1 ---+--- 2 ---+--- 3 ---+--- 4 ---+--- 5

.................................................. 50

.................................................. 100

.................................................. 150

.................................................. 200

.................................................. 250

.................................................. 300

.................................................. 350

.................................................. 400

.................................................. 450

.................................................. 500

.................................................. 550

.................................................. 600

.................................................. 650

.................................................. 700

.................................................. 750

.................................................. 800

.................................................. 850

.................................................. 900

.................................................. 950

.................................................. 1000

Linear regression Number of obs = 128

Replications = 1000

command: regress gas income price price2 priceinc

pr: -1*(1+_b[price]+_b[priceinc]*ln(15))/(2*_b[price2])

------------------------------------------------------------------------------

| Observed Bootstrap Normal-based

| Coef. Std. Err. z P>|z| [95% Conf. Interval]

-------------+----------------------------------------------------------------

pr | -14.13797 270.9505 -0.05 0.958 -545.1913 516.9153

------------------------------------------------------------------------------

Recall the generated statistic is in log form. A good question is whether you should present your Delta-method and Bootstrap confidence interval in logs or in levels... Think about it.

Appendix A: Partial Residual Plot Revisited

It is important to mention that all results presented here are based on a different data set (auto2.dta) than the data set used on the problem set 2 (gasnew.dat):

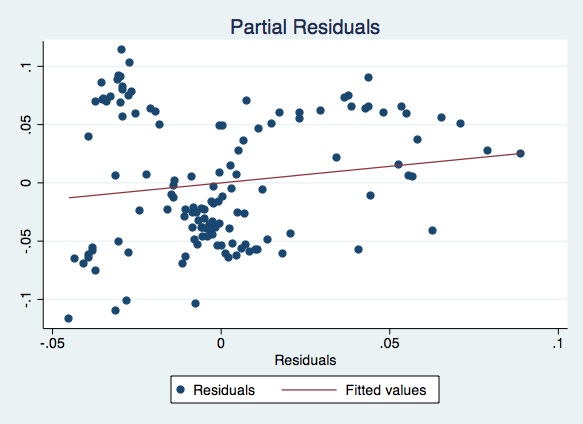

- Use the partial residual plot to check on the effect of the quadratic term. To obtain the partial residual plot with respect to the quadratic term you should :

1.1) Estimate model (2) without the regressor price2, and call this model (2.1)

quietly: regress gas income price priceinc1.2) Obtain the residuals of the model (2.1):

predict gasres, resid 1.3) Estimate model (2) using price2 instead of gas as the dependent variable; call it model (2.2):

quietly: regressprice2 income price priceinc

1.4) Obtain the residuals of the model (2.2):

predictpric2res, resid

1.5) Run the Gauss-Frisch-Waugh “regression”, and check if the slope coefficient is the same as in the original model (2):

regressgasres pric2res

Source | SS df MS Number of obs = 128

-------------+------------------------------ F( 1, 126) = 2.88

Model | .008694019 1 .008694019 Prob > F = 0.0921

Residual | .380276321 126 .003018066 R-squared = 0.0224

-------------+------------------------------ Adj R-squared = 0.0146

Total | .38897034 127 .003062759 Root MSE = .05494

------------------------------------------------------------------------------

gasres | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

pric2res | .2839261 .1672859 1.70 0.092 -.0471278 .6149801

_cons | 2.57e-10 .0048558 0.00 1.000 -.0096095 .0096095

------------------------------------------------------------------------------

1.6) Plot the the partial residuals, with a fitting line of predicted values

twoway (scatter gasres pric2res) (lfit gasres pric2res), title(Partial Residuals)

- Check whether there is a linear relationship between the residuals of the model (2.1) and the residuals of model (2.2). Draw your conclusion from what you see in the graph, and try to justify your answer in the light of basic assumptions of linear regression.

Please send comments to bottan2@illinois.edu or srmntbr2@illinois.edu?