e-TA 3: Introduction to Dynamic Models

Welcome to e-Tutorial, your on-line help to Econ508. This issue provides an introduction to dynamic models in Econometrics, and draws on Prof. Koenker's Lecture Note 3. The adopted philosophy is "learn by doing”: the material is intended to help you to solve the problem set 2 and to enhance your understanding of the topics.1

Data Set

The data set used in this tutorial was borrowed from Johnston and DiNardo's Econometric Methods (1997, 4th ed), but slightly adjusted for your needs. It is called AUTO2. You can download the data by visiting the Econ 508 web site (Data). As you will see, this adapted data set contains five series.

use AUTO2.dta, clear

describe obs: 128 AUTO2 adapted from Johnston and DiNardo, 1997

vars: 5 11 Sep 2002 12:22

size: 2,560

-----------------------------------------------------------------------------------------------------

storage display value

variable name type format label variable label

-----------------------------------------------------------------------------------------------------

quarter float %9.0g Quarter of the observation

gas float %9.0g Log of per capita real expenditure on gasoline and oil

price float %9.0g Log of the real price of gasoline and oil

income float %9.0g Log of per capita real disposable income

miles float %9.0g Log of miles per gallon

------------------------------------------------------------------------------------------------------

Sorted by:

Summarizing the data

A useful recommendation for practitioners of Econometrics is to summarize the data set you are going to work with. This provides a "big picture” of the variables and what you can expect from them. You can do that by as follows:

summarize Variable | Obs Mean Std. Dev. Min Max

-------------+--------------------------------------------------------

quarter | 128 1974.75 9.270052 1959.1 1990.4

gas | 128 -7.763027 .1201866 -8.019878 -7.606151

price | 128 4.723974 .1658683 4.488154 5.176053

income | 128 -4.19457 .153558 -4.50524 -3.969884

miles | 128 2.712568 .1348134 2.583997 3.035914

Even better, you can ask for the details of each variable:

summarize, detail

Quarter of the observation

-------------------------------------------------------------

Percentiles Smallest

1% 1959.2 1959.1

5% 1960.3 1959.2

10% 1962.1 1959.3 Obs 128

25% 1966.75 1959.4 Sum of Wgt. 128

50% 1974.75 Mean 1974.75

Largest Std. Dev. 9.270052

75% 1982.75 1990.1

90% 1987.4 1990.2 Variance 85.93386

95% 1989.2 1990.3 Skewness 1.81e-17

99% 1990.3 1990.4 Kurtosis 1.798007

Log of per capita real expenditure on gasoline and

oil

-------------------------------------------------------------

Percentiles Smallest

1% -8.016769 -8.019878

5% -8.005725 -8.016769

10% -7.974048 -8.015248 Obs 128

25% -7.836869 -8.012581 Sum of Wgt. 128

50% -7.719422 Mean -7.763027

Largest Std. Dev. .1201866

75% -7.671802 -7.628435

90% -7.64901 -7.625179 Variance .0144448

95% -7.636929 -7.620612 Skewness -.9293219

99% -7.620612 -7.606151 Kurtosis 2.503103

Log of the real price of gasoline and oil

-------------------------------------------------------------

Percentiles Smallest

1% 4.500299 4.488154

5% 4.531126 4.500299

10% 4.557322 4.515703 Obs 128

25% 4.621168 4.51949 Sum of Wgt. 128

50% 4.675815 Mean 4.723974

Largest Std. Dev. .1658683

75% 4.767021 5.130968

90% 5.016708 5.149823 Variance .0275123

95% 5.121161 5.162098 Skewness 1.180383

99% 5.162098 5.176053 Kurtosis 3.591608

Log of per capita real disposable income

-------------------------------------------------------------

Percentiles Smallest

1% -4.498873 -4.50524

5% -4.490103 -4.498873

10% -4.446543 -4.496271 Obs 128

25% -4.284298 -4.492739 Sum of Wgt. 128

50% -4.158388 Mean -4.19457

Largest Std. Dev. .153558

75% -4.105482 -3.978981

90% -4.006467 -3.971754 Variance .0235801

95% -3.985354 -3.971611 Skewness -.55278

99% -3.971611 -3.969884 Kurtosis 2.312228

Log of miles per gallon

-------------------------------------------------------------

Percentiles Smallest

1% 2.585882 2.583997

5% 2.590767 2.585882

10% 2.596746 2.586259 Obs 128

25% 2.613006 2.587764 Sum of Wgt. 128

50% 2.64715 Mean 2.712568

Largest Std. Dev. .1348134

75% 2.812479 3.013695

90% 2.950735 3.021156 Variance .0181746

95% 2.995482 3.028562 Skewness 1.069017

99% 3.028562 3.035914 Kurtosis 2.68393

Working with Time Series in Stata

The next step is to create the variables you will need to run dynamic models. Here you have two strategies:

(i) generate lags and differences using the command gen (explained in class)

(ii) convert your data set in time series, using the command tsset

Usually the strategy (ii) saves you time during the model selection

process. Hence, following (ii), you need to generate a variable

corresponding to the time period of each observation (which can not be

“quarter” because it contains non-integer values):

gen t = _n

label variable t "Integer time period" tsset t time variable: t, 1 to 128

delta: 1 unit

Now you are ready to work with time series. The main operators you will need are:

| 1-period lag: |

y(t-1) |

type: |

L.y |

| 2-period lag: |

y(t-2) |

type: | L2.y |

| ... |

|||

| 1-period lead: |

y(t+1) |

type: | F.y |

| 2-period lead: |

y(t+2) |

type: | F2.y |

| ... |

| Difference: |

y(t) - y(t-1) |

type: | D.y |

| Differerence of difference: |

[y(t)-y(t-1)] - [y(t-1)-y(t-2)] |

type: | D2.y |

| ... |

|||

| Seasonal difference: |

y(t) - y(t-1) |

type: | S.y |

| Lag-2 Seasonal difference |

y(t) - y(t-1) |

type: | S2.y |

| ... |

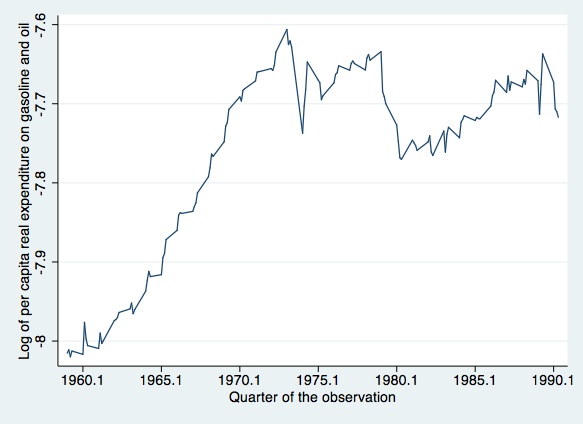

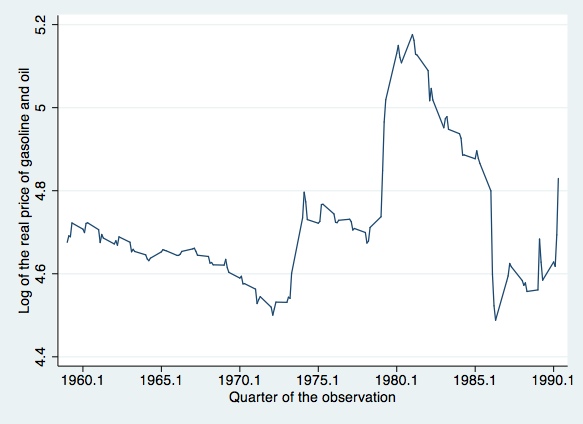

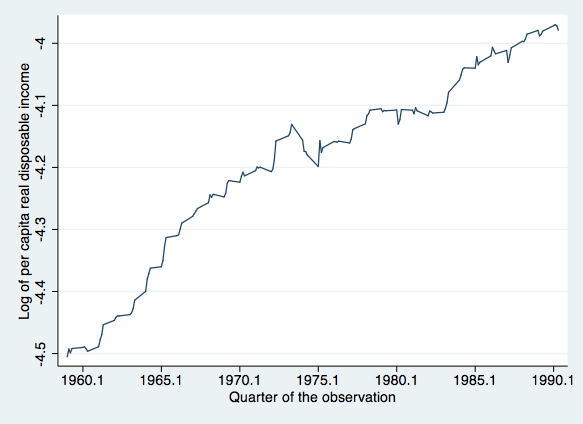

Graphing Time Series

Next we will try to replicate some of Johnston and DiNardo's (1997, p. 267) graphical results

line gas quarter, c(l) s(.) sort xlabel(1960.1 (5) 1990.1)

line pricequarter, c(l) s(.) sort xlabel(1960.1 (5) 1990.1)

line incomequarter, c(l) s(.) sort xlabel(1960.1 (5) 1990.1)

Running Dynamic Models

Next let’s run a typical dynamic model (Johnston and DiNardo, 1997, p. 269, Table 8.5):

regress gas price L.price L2.price L3.price L4.price L5.price income L.income

L2.income L3.income L4.income L5.income L.gas L2.gas L3.gas L4.gas L5.gas

Source | SS df MS Number of obs = 123

-------------+------------------------------ F( 17, 105) = 383.71

Model | 1.47998066 17 .087057686 Prob > F = 0.0000

Residual | .023823131 105 .000226887 R-squared = 0.9842

-------------+------------------------------ Adj R-squared = 0.9816

Total | 1.50380379 122 .012326261 Root MSE = .01506

------------------------------------------------------------------------------

gas | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

price |

--. | -.2676449 .0378744 -7.07 0.000 -.3427428 -.192547

L1. | .2628672 .0692914 3.79 0.000 .1254751 .4002592

L2. | -.0174063 .0754139 -0.23 0.818 -.1669381 .1321256

L3. | -.0720921 .0773891 -0.93 0.354 -.2255404 .0813562

L4. | .0143968 .0772103 0.19 0.852 -.1386968 .1674905

L5. | .0582077 .0463403 1.26 0.212 -.0336765 .1500919

|

income |

--. | .2927731 .1588226 1.84 0.068 -.0221427 .607689

L1. | -.1621984 .220227 -0.74 0.463 -.5988679 .2744712

L2. | -.0492554 .2143709 -0.23 0.819 -.4743133 .3758024

L3. | .0104172 .2131308 0.05 0.961 -.4121818 .4330161

L4. | .084901 .2101309 0.40 0.687 -.3317496 .5015517

L5. | -.1989616 .1531175 -1.30 0.197 -.5025654 .1046422

|

gas |

L1. | .6605733 .096063 6.88 0.000 .4700981 .8510485

L2. | .0670148 .1145346 0.59 0.560 -.1600861 .2941157

L3. | -.0235803 .1170941 -0.20 0.841 -.2557564 .2085957

L4. | .1321968 .119014 1.11 0.269 -.103786 .3681797

L5. | .1631249 .1013842 1.61 0.111 -.0379011 .364151

|

_cons | .0055429 .1260436 0.04 0.965 -.2443782 .2554639

------------------------------------------------------------------------------

Long-run Elasticities

Suppose you wish to compute the long run income and price elasticities. Assuming that in the long-run the variables converge to their respective steady-state values (represented by "e”):

\[gas_{t}=gas_{t-1}=gas_{t-2}=...=gas_{e}\]

\[price_{t}=price_{t-1}=price_{t-2}=...=price_{e} \] \[income(t)=income(t-1)=income(t-2)=...=income_{e}, \]

and recalling that all variables are already in logs, you then just have to apply this steady state condition, reparameterize the model, and calculate the elasticities:

\[ \frac{d (gas(e))}{ d (income(e))}= \text{long run income elasticity} \] \[ \frac{d (gas(e))}{d (price(e))} = \text{long run price elasticity } \]

After that you can compare the long-run elasticities of the (reparameterized) dynamic model with the elasticities provided by the static version of this log-linear regression:

regress gas price income

Source | SS df MS Number of obs = 128

-------------+------------------------------ F( 2, 125) = 218.86

Model | 1.42698222 2 .713491108 Prob > F = 0.0000

Residual | .407508656 125 .003260069 R-squared = 0.7779

-------------+------------------------------ Adj R-squared = 0.7743

Total | 1.83449087 127 .01444481 Root MSE = .0571

------------------------------------------------------------------------------

gas | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

price | -.1502843 .0312311 -4.81 0.000 -.2120945 -.0884742

income | .7056134 .0337348 20.92 0.000 .6388481 .7723787

_cons | -4.093342 .2247555 -18.21 0.000 -4.538161 -3.648523

------------------------------------------------------------------------------

I suggest you to provide a little table comparing those results, and write your comments about how the elasticities differ from the static to the dynamic model.

In the light of the problem set, I suggest you to compute not only the point estimate of the elasticities, but also their confidence intervals. In the static model, confidence intervals are obtained directly from the regression output. But for the dynamic model, the elasticities are represented by a non-linear function of the parameters. In that case, you need to find confidence intervals for the elasticities using Delta-method or Bootstrap techniques, which you will see in professor Koenker's Lecture Note 5 and we will address in a future e-TA.

Impulse Response Functions

Here I recommend to use the best dynamic model (following the Schwarz Information Criterion that you will see in e-Tutorial 5), and to compute impulse response functions using the formula on Prof. Koenker's Lecture Note 3, page 3.P.S.: Some authors propose alternative ways to calculate impulse response functions. One of them is to use partial derivatives (e.g., Enders, 1995, p.24), but such method has a drawback: it is quite easy to make a mistake when you have models with many lags and differences.

Usually it is expected that you account for a reasonable amount of response periods, depending on the structure of your data set. Usually we suggest a minimum of 40 (forty) response periods for quarterly data. Then you plot those responses along the respective time scale (t=0,1,2,3,...,40). This will generate the non-cumulative impulse response function. If you wish a cumulative impulse response function, at each new period t+i (i=1,2,3,...), you should add the effect to the previous shocks.

Please send comments to bottan2@illinois.edu or srmntbr2@illinois.edu